Dubai and the UAE have emerged as global investment hubs, attracting investors from across the world. With a strategic location, tax benefits, investor-friendly regulations, and a booming economy, the Emirates present lucrative opportunities for individuals and businesses alike. Whether you're a seasoned investor or just beginning your journey, understanding the dynamics of investments in Dubai and how to invest in the UAE is essential to maximizing your returns.

Why Choose Dubai and the UAE for Investments?

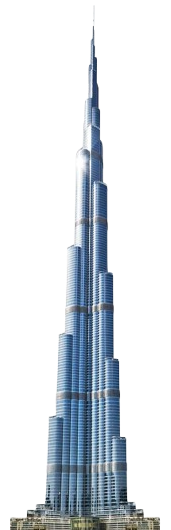

The UAE, particularly Dubai, is known for its modern infrastructure, strong legal framework, and economic diversification. Here’s why the region stands out:

#. Tax-Free Incentives

One of the biggest attractions is the absence of personal income tax and capital gains tax. Free zones in Dubai offer corporate tax exemptions for up to 50 years, making it a haven for investors.

#. Political and Economic Stability

The UAE maintains strong political stability and sound economic policies, supported by significant oil reserves and a push for diversification into tourism, logistics, finance, and technology.

#. Ease of Doing Business

The UAE consistently ranks high in global ease-of-doing-business indices. Streamlined regulations, digital government services, and a robust legal system support smooth business operations.

Top Investment Options in Dubai and the UAE

1. Real Estate Investments in Dubai

Dubai’s real estate market remains one of the most profitable sectors for investors. From luxury villas to commercial properties, the sector has shown resilience and steady growth.

#. Key Benefits:

- High rental yields (5% to 9%)

- No property tax

- Freehold areas allow full ownership for foreigners

- Golden Visa eligibility for real estate investors

Popular locations include Downtown Dubai, Dubai Marina, Business Bay, and Jumeirah Village Circle.

2. Stock Market Investments

Investing in the UAE’s stock markets like the Dubai Financial Market (DFM) or Abu Dhabi Securities Exchange (ADX) can offer impressive returns.

#. Benefits:

- Access to publicly listed companies

- Opportunities in banking, telecom, real estate, and energy sectors

- Regulated by the Securities and Commodities Authority (SCA)

Investors can buy shares through licensed brokers and track their portfolios online.

3. Mutual Funds and ETFs

Mutual funds and exchange-traded funds offer diversified exposure with managed risk, ideal for those who prefer a hands-off investment approach.

#. Why consider this?

Professionally managed portfolios

Lower capital requirement

Exposure to international markets via UAE-based funds

4. Startups and Angel Investing

Dubai has become a startup hub with government-backed initiatives like Dubai Future Foundation, Hub71 in Abu Dhabi, and accelerators like in5.

#. Perks of investing in startups:

High growth potential

Government support through funding and innovation centers

Access to diverse sectors like fintech, healthtech, and e-commerce

5. Gold and Precious Metals

Dubai, known as the "City of Gold," provides a safe and liquid market for investing in gold, silver, and other metals. These can be purchased physically or through ETFs.

Steps to Invest in UAE Successfully

Step 1: Define Your Investment Goals

Understand your financial objectives whether it's passive income, long-term capital appreciation, or portfolio diversification.

Step 2: Choose the Right Investment Vehicle

Based on your goals and risk tolerance, select from real estate, stocks, mutual funds, or business ventures.

Step 3: Get Your Finances in Order

Open a UAE bank account and ensure compliance with the local Know Your Customer (KYC) norms. Consider consulting a financial advisor for portfolio planning.

Step 4: Legal and Residency Requirements

Foreign investors can apply for investor or Golden Visas based on the size and type of their investments in Dubai.

Step 5: Monitor and Adjust

Stay updated on market trends and economic developments in the UAE. Review your investment portfolio regularly to ensure it aligns with your evolving goals.

Risks and Considerations

While the UAE is an attractive investment destination, it's essential to be aware of the potential risks:

#. Market Volatility: Real estate and stock markets can fluctuate with global economic changes.

#. Regulatory Changes: New laws or changes in business policies may affect returns.

#. Currency Risks: If you're investing from abroad, changes in forex rates may impact your ROI.

To mitigate these, diversify your investments and seek advice from licensed investment consultants in Dubai or the broader UAE.

Future of Investments in Dubai and UAE

Dubai and the UAE continue to innovate, attracting global capital through:

#. Smart City and AI initiatives

#. Green energy and sustainability projects

#. Expo 2020 legacy developments

#. Vision 2030 and Vision 2071 plans

These initiatives pave the way for new sectors to flourish, such as renewable energy, health tech, and digital finance—opening fresh avenues for those looking to invest in the UAE.

Conclusion

Whether you're looking to build wealth, secure your retirement, or diversify your portfolio, exploring investments in Dubai and the wider UAE market can be a game-changer. With strong governance, modern infrastructure, and future-forward initiatives, the UAE offers a robust environment for local and global investors.

From real estate and stocks to startups and gold, the Emirates provide options for every risk appetite and financial goal. But remember, informed decision-making backed by expert guidance is the key to unlocking long-term financial success.